Summary of the latest Tourism Spend Data 2016

MBIE has recently released some interesting data on tourism spend (Regional Tourism Estimates). We thought we would share with you some of the key statistics relevant to the hospitality and commercial accommodation sectors.

Overall

The latest Tourism spend data from MBIE shows continued growth over the last five years with an increase of $1,518 million in 2016 over the previous year, making tourism one of the key economic drivers for 2016.

Domestic tourism spend is up $728 million with the majority taking place in Auckland followed by Canterbury, Waikato, Otago and Wellington regions. General positivity in the economy from increased house prices and higher levels of employment provides a positive outlook for many and this often translates into increased spending. Conversely when things aren’t going so well we often see a decrease in discretionary spend.

International tourism spend is up $790 million on the previous year with the largest portion spent in Auckland. The second and third spending regions for international tourism are Otago and Canterbury. The increase in tourist spend is reflective of the continued increase in international arrivals to New Zealand over the last 3 years.

Currently the largest contributors to international spend are visitors from Australia, China, the UK and the USA. Each of these countries have seen an increase in international arrivals to New Zealand across previous years with the Chinese market being the second largest contributor behind Australia. The Chinese market continues to grow through the efforts of targeted marketing campaigns and increased air capacity.

Accommodation

Overall spend in the accommodation sector grew by $154 million in 2016 with international spending up $48 million following a stagnant couple of years. An increase of $106 million was recorded for domestic tourist spend.

The majority of international spending in the accommodation sector originates from the Australian and Chinese markets with a large portion of spending taking place in the Auckland, Otago and Canterbury regions. The increase in accommodation visitor spend is influenced by the increase in international arrivals to New Zealand – more tourists means more demand for accommodation.

Similarly Auckland, Otago and Canterbury saw the highest proportion of domestic tourist spend. The Wellington, Waikato and Bay of Plenty regions also saw a significant portion of spending from domestic travellers. Increased spending due to economic security often translates to more holidays and time spent away from home. This also translates to business travel, whereby a stronger economy means businesses are more likely to send staff away on business trips, requiring additional overnight accommodation and meals out.

Food and Beverage

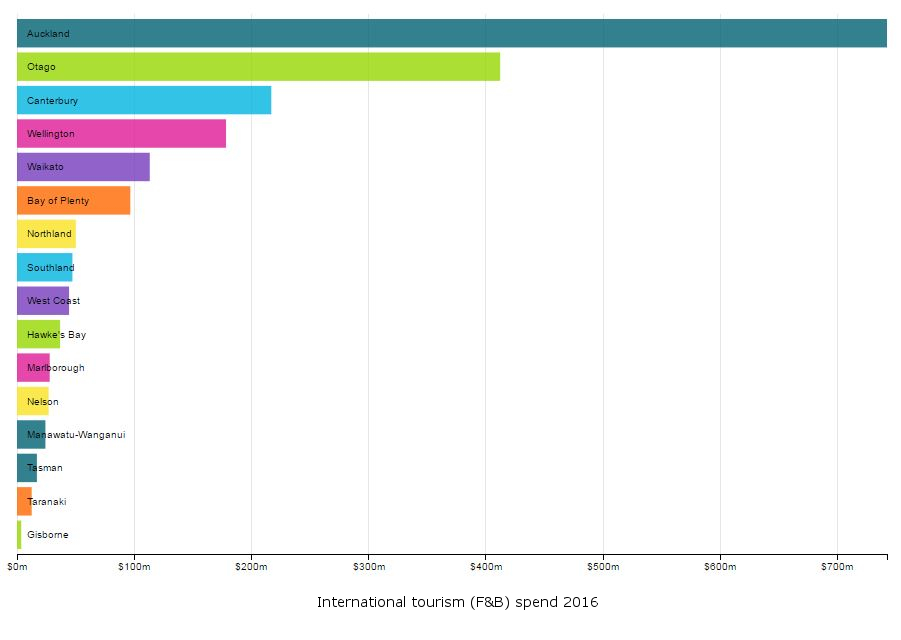

The food and beverage sector’s tourism spend saw an overall increase of $509 million for 2016. This was produced by a $177 million increase in domestic spending and a $332 million increase in international spending. With a higher volume of international visitors around than previous years and more New Zealanders feeling the urge to eat out a bit more often, the overall tourist market has seen solid growth. This, in turn, has presented more opportunities for F&B businesses to capitalise on the increased demand.

The majority of spending for both domestic and international was seen in Auckland however Waikato, Wellington, Canterbury and Otago saw significant portions of domestic spending while Otago alone took almost double its nearest competitor (Canterbury) in international spending.

To read the full article, click here.